The bigger portion of dark turnover is accounted for by traders either using devoted dark algos, sending guide submissions, or using “Dark Would” style performance. In any of those instances, the order sizes are usually disproportionately massive. Setting an MEQ can have a really pronounced effect on your fill price, and on the quantity of signaling that you just give out to the market.

For merchants with large orders who are unable to position them on the common public exchanges, or wish to avoid telegraphing their intent, darkish pools provide a market of consumers and sellers with the liquidity to execute the trade. As of Feb. 28, 2022, there have been sixty four dark pools operating within the United States, run mostly by investment banks. The common size of a dark pool transaction has dropped to little more than one hundred eighty to 200 shares per transaction. Nevertheless, dark pool exchanges are good for institutional buyers looking to act upfront of market information. These merchants typically have far more expertise than a retail investor.

However, it could be useful for institutional investors and corporations. When large scale investors plan to purchase or sell a substantial quantity of stock, it could affect different investors to do the identical. However, there’s nonetheless vital risk that comes with this type of investing. Dark pools, otherwise known as Alternative Trading Systems (ATS), are authorized personal securities marketplaces.

At the chance of belabouring the swimming pool analogy, it could act as a lifeguard and cease you from diving head-first into the shallow finish. You can consider the built-in order varieties as basically a visit wire for data. You wish to jump into the deeper end of the pool, together with your shorts nonetheless on. As a retail investor not solely will you might have relatively little use for the anonymity that a darkish pool trade offers, you may also expose your self to several dangers not present on a public change.

What Are Dark Pools In Cryptocurrency?

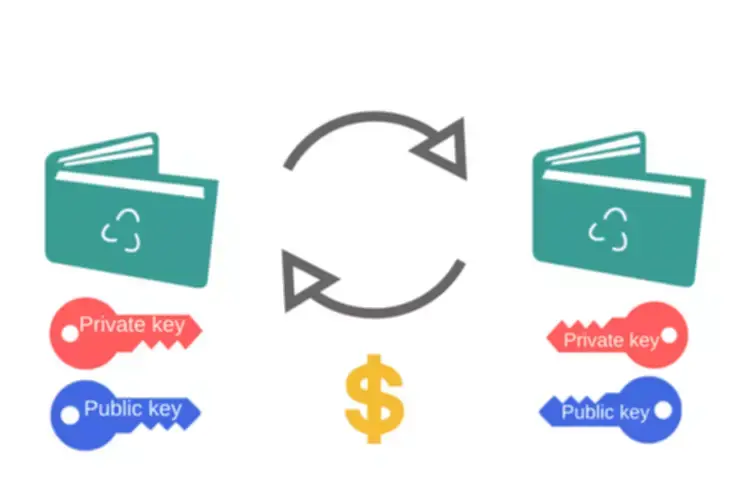

This permits them to make trades without having to clarify their rationale as they search for patrons or sellers. Dark swimming pools, the considerably menacing-sounding name for personal electronic forums, allow establishments to commerce instantly with one another outdoors of the central stock change. Dark swimming pools are named for their complete lack of transparency and are not obtainable to the investing public. In spite of the sinister term, darkish pools happened to assist investors perform massive block trading orders without negatively impacting the market. Proponents of dark pool trading level to lowered buying and selling fees and prices, and say market members nonetheless profit if they’re invested in mutual and pension funds. To avoid the transparency of public exchanges and ensure liquidity for big block trades, several of the investment banks established personal exchanges, which got here to be generally identified as dark pools.

If the new information is reported only after the trade has been executed, however, the information has much much less of an influence available on the market. Dark swimming pools are privately organized exchanges that are used to trade monetary securities. Unlike conventional exchanges, dark pools aren’t available to on a daily basis retail traders. Instead, they’re meant for institutional buyers who frequently place massive orders for his or her purchasers. The purpose is to keep away from affecting the market when these large block orders are positioned.

The “lift” comes when different investors see Icahn’s interest and leap in, causing the inventory price to rise. The different platforms – the lit market, non-midpoint darkish swimming pools and darkish swimming pools – have been tailored to institutional demand. The market has labored out an environment friendly method to make sure that the dual priorities of value and immediacy are balanced.

Broker-dealer-owned Darkish Pool

When subsequent orders are executed, earnings are instantly obtained by HFT traders who then close out their positions. This form of legal piracy can happen dozens of instances a day, reaping huge dark market trading gains for HFT traders. Dark pool investing isn’t normally one thing the typical retail investor will participate in.

The change market (or, for our functions, the “lit market”) is one of the best known platform to buy and sell equity shares. Dark pools had been established to assist fulfill such a necessity for smaller exchanges in order to fulfill liquidity necessities. Many private monetary exchanges have been established, and it facilitated traders who acquired very giant orders and couldn’t full them on conventional public exchanges. Dark swimming pools add to the efficiency of the market since there might be extra liquidity for certain securities by getting them to listing on the exchanges. Most everyday retail traders buy and sell securities with out ever impacting the worth of the underlying security since there are so many excellent securities on the secondary market. However, an institutional investor possesses the shopping for power to purchase or sell sufficient securities to actually transfer the prices of the securities.

Otc Vs Exchange Trading Vs Dark Swimming Pools

The recent HFT controversy has drawn vital regulatory consideration to darkish swimming pools. Regulators have typically considered dark swimming pools with suspicion due to their lack of transparency. This controversy could lead https://www.xcritical.com/ to renewed efforts to curb their attraction. One measure which will help exchanges reclaim market share from darkish pools and different off-exchange venues could be a pilot proposal from the Securities and Exchange Commission (SEC) to introduce a trade-at rule.

Dark pools provide pricing and price benefits to buy-side institutions similar to mutual funds and pension funds, which hold that these advantages finally accrue to the retail buyers who own these funds. However, dark pools’ lack of transparency makes them prone to conflicts of curiosity by their house owners and predatory buying and selling practices by HFT firms. HFT controversy has drawn growing regulatory attention to darkish pools, and implementation of the proposed “trade-at” rule could pose a threat to their long-term viability.

Exchange-owned Dark Pools

For example, Bloomberg LP owns the darkish pool Bloomberg Tradebook, which is registered with the SEC. Dark pools have been initially mostly utilized by institutional buyers for block trades involving a lot of securities. A 2013 report by Celent discovered that as a outcome of block orders shifting to dark pools, the average order measurement dropped about 50%, from 430 shares in 2009 to approximately 200 shares in 4 years. Over the final decade, there was an growth in buying and selling in dark swimming pools or off the lit market. In the United States, no less than 30 p.c of equity buying and selling happens off the general public exchanges.

For giant establishments, selling blocks of shares can actual a toll, either when it comes to cost or persistence. At the top of the pecking order are venues with the lowest cost and lowest immediacy. Those with the very best cost and highest immediacy go on the backside.

But some dark swimming pools offer various degrees of pricing to the publicly quoted prices on public equity exchanges. If the quantity of trading in dark pools owned by broker-dealers and electronic market makers continues to develop, stock prices on exchanges may not mirror the actual market. For instance, if a well-regarded mutual fund owns 20% of Company RST’s stock and sells it off in a darkish pool, the sale of the stake might fetch the fund a good value. Unwary traders who just bought RST shares may have paid too much because the inventory may collapse once the fund’s sale turns into public information. A dark pool is a privately organized financial forum or change for buying and selling securities.

Are You Capable To Commerce On Dark Pools?

The non-displayed order book enabling to trade stocks at the mid-point of Euronext’s Primary Best Bid and Offer and to remove the buying and selling latency coming from darkish pools of London-based MTFs. Dark swimming pools work in a unique way, although, so let’s take a hypothetical look at how this kind of trading works. Say ABC Investment Firm sees an excellent alternative in Company 123 and decides to purchase 20,000 shares in the company. Since they can’t buy these shares on the open market, the firm has to go onto a dark pool to make the purchase.

As a broker’s need to commerce becomes more urgent, they transfer from low-cost/low-immediacy venues to high-cost/high-immediacy platforms, we discovered. There is a certain expectation that buying and selling in a darkish pool minimises your value influence on a inventory. However, the primary purpose a dark order can have a great amount of impression in Australia is easy supply-demand mechanics. A block trade is solely simply the sale or purchase of a very large variety of securities between two parties. However, it’s normally a trade that is so large that it might lead to a tangible impression on the safety value.

Uses Of Dark Swimming Pools

In Europe, off-exchange trading venues represent forty p.c of fairness trading. Dark pools are additionally utilized in Australia, Canada and the United Kingdom. CFA Institute members have raised issues that the incentive to show orders in public markets is being undermined by sure off-exchange trading practices. In flip, these considerations have implications for public price discovery, liquidity, and the quality and integrity of markets. On the flip facet, broker darkish pools have continued to lose share in Australia (FIGURE 1 shows their comparatively small contribution to general notional). In 2013, ASIC applied a “meaningful value improvement” rule as part of its Market Integrity Rules.