To determine the average number of days it took to get invoices paid, you must divide the number of days per year, 365, by the accounts receivable turnover ratio of 11.4. The manufacturing company has to purchase and store the raw materials that it uses for production. There is cost involved in the acquisition process in the form of purchase, transportation as well as storage. In case of perishable goods this cost goes up because of some special arrangements that these products require during the transportation and storage process. Thus it is necessary to sell off the final goods as fast as possible so that wastage is minimum and revenue is maximum.

How to Calculate FICA Tax: A Step-by-Step Guide

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. An accounts receivable is the sum of the beginning and ending account balances divided by two. However, it’s worth noting that a high ratio could also mean that you operate largely on a cash basis as well. This article provides an overview of important accounting ratios and formulas.

Creditors Turnover Ratio

We can interpret the ratio to mean that Company A collected its receivables 11.76 times on average that year. In other words, the company converted its receivables to cash 11.76 times that year. A company could compare several years to ascertain whether 11.76 is an improvement or an indication of a slower collection process. The capital employed turnover ratio indicates the efficiency with which a company utilizes its capital employed with reference to sales. It finds out how efficiently the assets are employed by a firm and indicates the average speed with which the payments are made to the trade creditors. The inverse of this ratio, when multiplied by 365, gives the average number of days a payable remains unpaid.

What Is Asset Turnover Ratio and How Is It Calculated?

If your ratio is low, it may indicate that you need to improve the checks you do into the creditworthiness of your customers. Turnover ratio is also used to measure the receivable cycle which is very important for any business because it shows how quickly the company is able to collect its dues. If this cycle is long, it signifies that cash is blocked and cannot be used for daily operations which may lead to cash crunch and borrowing. Liquidity refers to the ease with which an asset can be converted into cash without losing value.

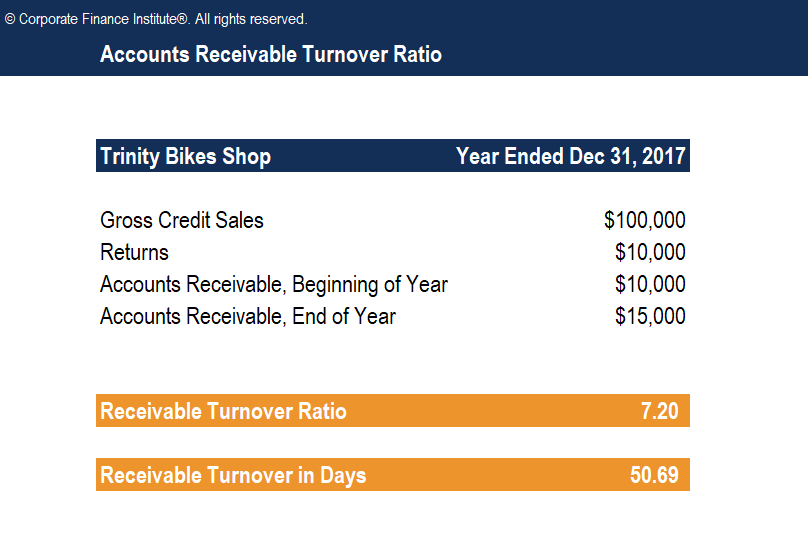

- You’ll divide your net credit sales by your average accounts receivable to calculate your accounts receivable turnover ratio, or rate.

- As a result, customers might delay paying their receivables, which would decrease the company’s receivables turnover ratio.

- A high receivables turnover ratio can indicate that a company’s collection of accounts receivable is efficient and that it has a high proportion of quality customers who pay their debts quickly.

- It measures a company’s ability to meet its short-term financial obligations.

- Since you can never be 100% sure when payment will come in for goods or services provided on credit, managing your own business’s cash flow can be tricky.

Our Team Will Connect You With a Vetted, Trusted Professional

To calculate and compare net credit sales, you need to use a consistent time frame, such as monthly or the first quarter. Net credit sales is income that you’ll collect later because you’ve provided self-employment tax goods or services on credit. It shows the amount of sales revenue you’ve earned that’s on credit, less any returns and allowances such as a reduced price due to a problem of some sort.

GOBankingRates works with many financial advertisers to showcase their products and services to our audiences. These brands compensate us to advertise their products in ads across our site. We are not a comparison-tool and these offers do not represent all available deposit, investment, loan or credit products. This is the most common and vital step towards increasing the receivable turnover ratio. In the fiscal year ending December 31, 2020, the shop recorded gross credit sales of $10,000 and returns amounting to $500.

It is often used to compare businesses with their competitors to analyse the performance, growth, and future opportunities so stakeholders can make informed investment decisions. The ratio is used to measure the efficiency of your company’s operations. GOBankingRates’ editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services – our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

It also helps them analyze how efficiently the stock and its reordering is being managed by the purchasing department. Access Xero features for 30 days, then decide which plan best suits your business. Once you know how old your outstanding invoices are, you can work on it accordingly to increase revenue from them or also make a note of those who haven’t paid yet for further follow-ups. The year-over-year growth formula is one of the most reliable ways of tracking your long-term growth. When you know where your business stands, you can invest your time in solving the problem—or getting even better. Since industries can differ from each other rather significantly, Alpha Lumber should only compare itself to other lumber companies.

It may not be very effective as an indicator for businesses that depend on cash sales such as grocery stores. And some manufacturers have a longer credit payment time period, especially for big-ticket items. The numerator of the accounts receivable turnover ratio is net credit sales, the amount of revenue earned by a company paid via credit.

See our examples section below for a comprehensive example that applies this step-by-step process. For small business owners like you, succeeding goes beyond simply surviving. And with a few solid years under your belt, your small business is ready to take the world by storm.