Estimate your savings or spending through our compound interest calculator. Enter your initial amount, contributions, rate of return and years of growth to see how your balance increases over time. The TWR figure represents the cumulative growth rate of your investment. Because many investments do not pay a consistent interest rate, but are rather the average of a fluctuating market, the compound annual growth rate (CAGR) assumes compound growth over time to provide a projected rate of return. Compound interest, on the other hand, puts that $10 in interest to work to continue to earn more money.

How Does Compound Interest Grow Over Time?

When you invest in the stock market, you don’t earn a set interest rate, but rather a return based on the change in the value of your investment. If you left your money in that account for another year, you’ll earn $538.96 in interest in year two, for a total of $1,051.63 in interest over two years. You earn more in the second year self billing of tax invoices because interest is calculated on the initial deposit plus the interest you earned in the first year. See how your savings and investment account balances can grow with the magic of compound interest. When interest compounding takes place, the effective annual rate becomes higher than the nominal annual interest rate.

Set Monthly or Annual Contributions

Number of Years to Grow – The number of years the investment will be held. Expectancy Wealth Planning will show you how to create a financial roadmap for the what is a preferred return how do they work in real estate rest of your life and give you all of the tools you need to follow it. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. It is for this reason that financial experts commonly suggest the risk management strategy of diversification.

- Because many investments do not pay a consistent interest rate, but are rather the average of a fluctuating market, the compound annual growth rate (CAGR) assumes compound growth over time to provide a projected rate of return.

- Compound interest is the addition of interest to the existing balance (principal) of a loan or saving, which, together with the principal, becomes the base of the interest computation in the next period.

- Compound interest is the formal name for the snowball effect in finance, where an initial amount grows upon itself and gains more and more momentum over time.

During the second year, instead of earning interest on just the principal of $100, you’d earn interest on $110, meaning that your balance after two years is $121. While this is a small difference initially, it can add up significantly when compounded over time. After 20 years, the investment will have grown to $673 instead of $300 through simple interest.

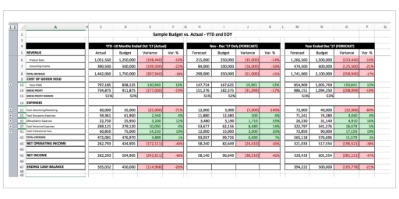

We’ll use a 20 yearinvestment term at a 10% annual interest rate (just for simplicity). As you compare the compound interest line tothose for standard interest and no interest at all, you can see how compounding boosts the investment value. The easiest way to take advantage of compound interest is to start saving! Just enter your beginning balance, the regular deposit amount at any specified interval, the interest rate, compounding interval, and the number of years you expect to allow your investment to grow. This flexibility allows you to calculate and compare the expected interest earnings on various investment scenarios so that you know if an 8% return, compounded daily is better than a 9% return, compounded annually.

You’re our first priority.Every time.

Automating your savings means money moves automatically into a savings account – either through a split direct deposit or through a recurring transfer from your checking to your savings account. outstanding shares meaning ______ Addition ($) – How much money you’re planning on depositing daily, weekly, bi-weekly, half-monthly, monthly, bi-monthly, quarterly, semi-annually, or annually over the number of years to grow. Using the definition above, the compound interest rate is the annual rate where the compounding frequency is taken into account.

Invest Like Todd

The amount due increases as the interest grows on top of both the initial amount borrowed and accrued interest. I hope you found this article helpful and that it has shown you how powerful compounding can be—and why Warren Buffett swears by it. With savings and investments, interest can be compounded at either the start or the end of the compounding period. Ifadditional deposits or withdrawals are included in your calculation, our calculator gives you the option to include them at either the startor end of each period.

Compound interest is often compared to a snowball that grows over time. Much like a snowball at the top of a hill, compound interest grows your balances a small amount at first. Like the snowball rolling down the hill, as your wealth grows, it picks up momentum growing by a larger amount each period. The longer the amount of time, or the steeper the hill, the larger the snowball or sum of money will grow.