From these permanent records, periodical statements are prepared to show the trading profit or loss made by the business and its assets and liabilities, at any given date. If you’re more of an accounting software person, the general ledger isn’t something you use but an automated report you can pull. Your software of choice will probably have an option to “View general ledger,” which will show you all the journal entries you’ve entered (for a given time frame).

These include sales accounts, purchases accounts, inventories accounts, etc. A general ledger contains all the ledger accounts outside of the sales and purchases accounts. Therefore, you need to prepare various sub-ledgers providing the requisite details to prepare a general ledger.

Accounting 101 for Small Businesses

These transactions are organized by accounts together with their dates, descriptions, and account balances—enough information to give you a bird’s-eye view of your business’s financial health. You may include individual assets and accounts like accounts payable and receivable, liabilities, inventory, and investments. This information is used to prepare financial reports, monitor finances, track cash flow, and prevent accounting errors or fraud. how to prepare and analyze a balance sheet +examples Make it easier to keep track of your transactions, account debits and credits, tax deadlines, and more by incorporating FreshBooks accounting software into your business’s bookkeeping and accounting processes.

How a General Ledger Works With Double-Entry Accounting Along With Examples

- After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- If you are preparing the journal or ledger manually, you or your accountant will need to go through each of the accounts individually.

- A bank statement is essentially a record of all the activity within an individual account, showing the date of each transaction.

- Neither are an outcome of your core business activity, nor are such expenses related to your core business operations.

- Have more time to work on what you love when you spend less time on bookkeeping.

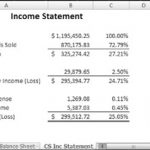

FreshBooks has everything you need, including journal entries, accounts payable, balance sheets, and more, freeing you up to work on growing your company and increasing profits. When expenses spike in a given period, or a company records other transactions that affect its revenues, net income, or other key financial metrics, the financial statement data often doesn’t tell the whole story. In the case of certain types of accounting errors, it becomes necessary to go back to the general ledger and dig into the detail of each recorded transaction to locate the issue. At times this can involve reviewing dozens of journal entries, but it is imperative to maintain reliably error-free and credible company financial statements. You need to compare the closing trial balances of previous accounting periods to the opening balances of the current period’s ledger accounts.

But, you can refer to the related subsidiary account if you need to check any detail regarding the sales made to a specific customer. Adapt the ledger to suit your working style, while keeping it up-to-date and accurate. Double-check record accuracy routinely to prevent accounting errors so you can use the information within to more-precisely track your company’s growth. In the following article, we will what is another word for ‘best practice’ explore more about general ledger accounting, and how you can use FreshBooks software to simplify your bookkeeping as you track your company’s finances. A subsidiary ledger (sub-ledger) is a sub-account related to a GL account that traces the transactions corresponding to a specific company, purchase, property, etc. Since increases in assets are debited and decreases in assets are credited, a transaction resulting in an increase in one asset and a decrease in another asset will in effect have equal debit and credit entries.

Types of Ledger Accounts

The only difference is that the balance is ascertained after each entry and is written in the debit or credit column of the account. In the standard format of a ledger account, the balance is not stated after each transaction. The standard form of a ledger account does not show the balance after what is a bond sinking fund each entry.

General Ledger Sample Format

The accountant would then increase the asset column by $1,000 and subtract $1,000 from accounts receivable. The equation remains in balance, as the equivalent increase and decrease affect one side—the asset side—of the accounting equation. The ledger is a book in which all accounts relating to a business enterprise are kept. In other words, it is the collection of all accounts of a business enterprise. The following rules are applied to record these increases and decreases in individual ledger accounts.

As the business grows and the number of accounting staff increases it is impractical to have only one ledger. In these circumstances it is common to split off sections of the main ledger into separate subledgers. For this reason the ledger is sometimes known as the book of final entry or the book of secondary entry. Now let’s move on to talk about debits vs. credits and how they work in an accounting system.