The first step involves developing equations to reflect the relationships between the service departments and the producingdepartments, i.e., equation form [2] presented above. After these equations are developed, they are used to allocate the service department costs directly tothe producing departments in the second step. Although this is the simplest method, it is also the least accurate method. Whether through push allocations, pull allocations, or driver-based methods, companies must tailor their cost allocation approach to their specific needs and goals.

Direct allocation method

For instance, if a company has a centralized HR department, its costs would be allocated to all departments that benefit from HR services. Moreover, technology enables more sophisticated analysis and visualization of cost data. Advanced analytics and business intelligence tools can uncover hidden cost drivers and inefficiencies, providing actionable insights for management. For example, a data analytics platform might reveal that a particular department’s high travel expenses are due to inefficient booking practices, prompting a review and potential policy changes. These insights can lead to more informed decision-making and strategic adjustments, ultimately enhancing organizational efficiency and profitability. Clear communication about how and why costs are allocated can mitigate potential conflicts and foster a culture of trust.

Activity-Based Costing (ABC)

As businesses grow more complex, traditional methods of cost allocation may no longer suffice. Modern management requires innovative approaches to distribute costs fairly and transparently across various departments and services. Discover modern cost allocation methods to enhance management efficiency and optimize resource distribution in multi-department organizations. Under the direct charge off method, simply charge the cost of service departments to expense as incurred. This is the simplest and most efficient method, but it does not reveal how costs are incurred, and tends to accelerate expense recognition. Nonetheless, it is an efficient accounting approach when your accounting staff is not overly skilled, and you have no interest in allocating costs.

Methods of Cost Allocation

In response to this, some firms might opt to use variable costing as a supplement, which includes only those costs that change with production volume. This can provide a more relevant basis for operational and tactical decision-making. Cost allocation in decision making is integral to multiple areas of a business. A few of these areas, such as pricing, budgeting, and investment decisions, leverage cost allocation heavily. Luckily, modern planning software can transform cost allocation from a time-consuming, Excel spreadsheet-based headache into a precise, streamlined process.

Some critics argue that this introduces a degree of arbitrariness that may distort the true cost picture. Direct allocation, sometimes referred to as the direct method, is the most straightforward approach to cost allocation. One of the most common mistakes is to allocate indirect expenses based on current how to fill out and file form w production volume. Other issues include not performing cost allocation at all or using arbitrary rates rather than industry standards. When deciding how to allocate these types of expenses, companies should consider their company’s size and what it will cost to produce a certain amount of output.

Products

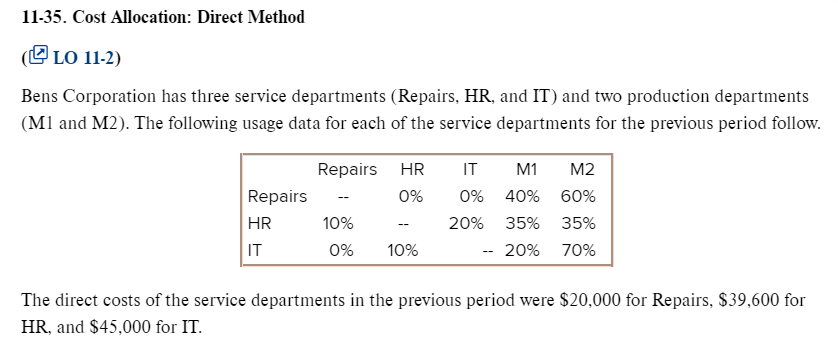

The direct allocation method is a technique for charging the cost of service departments to other parts of a business. This concept is used to fully load operating departments with those overhead costs for which they are responsible. The plant wide rates provide inaccurate product costs because the products do not consume the indirect resources in the same proportions in each of the two departments. The step-down, or sequential method, ignores self services, but allows for a partial recognition of reciprocal services. As a result, the step-down method is different from thedirect method in that some service department costs are allocated to other service departments.

- Instead, they should begin with the data they have, refine their methods over time, and use the insights gained from initial allocations to improve data collection and cleansing processes.

- This allocation helps formulate realistic budgets, ensuring cost efficiency and operational effectiveness.

- Service department costs must be assigned (applied, allocated, or traced) to the inventory for product costing purposes.

- Businesses, with clarity on cost division across departments, processes, or products, can plan budgets more effectively.

- This exhibit shows the same data thatappears in Exhibit 6-3 except service costs are separated into fixed and variable elements.

Describe three general methods of assigning costs to products including one stage and two stage approaches.4. Discuss the circumstances under which each of the methods referred to in learning objective 3 will provide accurate product costs.5. Describe the direct, step-down and reciprocal methods of allocating service department costs to producing departments.6.

The company might determine the proportion of space each department uses to allocate these costs. If production uses 40% of the total space, R&D uses 30%, and administration uses 30%, the company would allocate 40% of the indirect costs to production, 30% to R&D, and 30% to administration. Allocation is distributing costs among different departments or product lines in an organization.

A disadvantage of using the dual rate method is that idle capacity costs for theservice departments are allocated to the user departments. This problem is eliminated by using the single budgeted rate method illustrated below. First stage allocations may include self services and reciprocal services between service departments, as well as services to producing departments. Self service refers to situationswhere service departments use some of their own service.

Instead, they should begin with the data they have, refine their methods over time, and use the insights gained from initial allocations to improve data collection and cleansing processes. This iterative approach can help organizations continuously improve their cost allocation practices as they gain more insights into their cost drivers and resource usage. Another common method is the Direct Allocation method, which assigns costs directly to cost objects without any intermediate cost pools. It is often used in smaller organizations where the complexity of operations does not justify the need for more sophisticated allocation methods. For instance, a small consulting firm might allocate administrative costs directly to client projects based on billable hours, providing a straightforward way to manage expenses.

Explore the intricacies of cost structures, including direct and indirect costs, and learn about various cost allocation methods across different industries. Cost allocation affects budgeting, virtually shaping every financial decision a company makes. Businesses, with clarity on cost division across departments, processes, or products, can plan budgets more effectively. They can identify which areas are cost-intensive and adjust the budget proportionately. Without the right cost allocation, a budget may not accurately reflect the financial resources needed or generated by different business segments.